A Better Approach to Eldercare

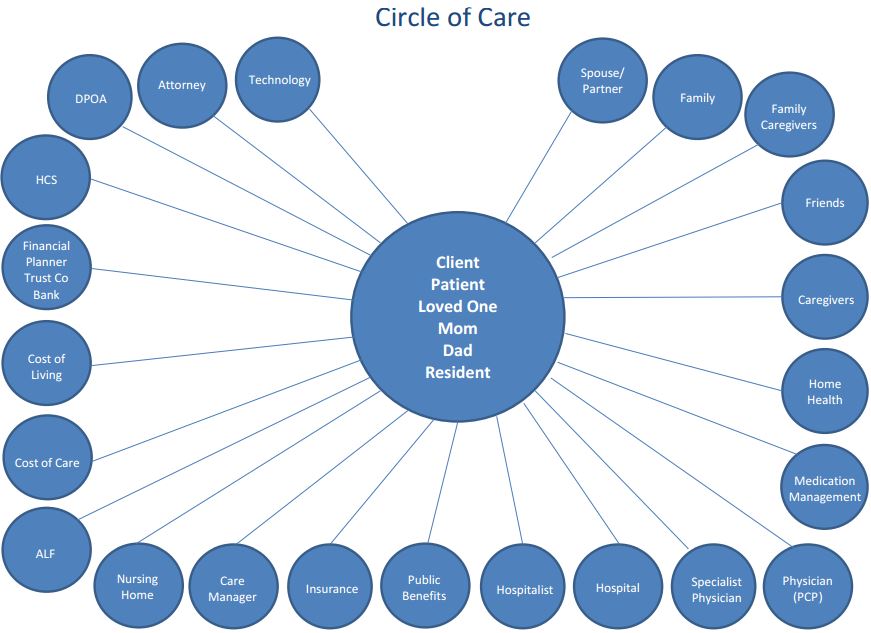

This client circle of care depicts the care team involved with an elderly or disabled client (also known as “the patient”, “Mom”, “Dad”, “Aunt Betty”, “resident”, “care recipient”). As our founders, Linda Chamberlain and Dr. Kerry Chamberlain, presented on “A Better Approach to Eldercare” at last week’s Aging in America conference, the focus was on how to harness the power of this care team to ensure the approach remains centered on the client.

The first stage in this approach is the beginning conversation. Too often, conversations around eldercare are done within silos and are focused by what the particular specialty wants to cover. Rather than working together (and starting with the client’s priorities), the individual may be blind to what is going on in the client’s life outside his/her office. Unfortunately, this can turn the experts’ best solutions in to failure.

In “A Better Approach to Eldercare”, Linda and Kerry discussed using a comprehensive questionnaire to begin this conversation. This serves to help the client and family gather facts and information that will be needed to make informed decisions and gets information organized to spur the conversation (i.e. bring up “issues”). While a professional may not immediately address all the issues (or ever address them in his/her specialty specifically), having a broad sense of information guides the conversation, helps inform proper recommendations and points to issues that need to be addressed to make the whole puzzle work. It is also vital to understand what the client’s and family’s main concerns are. A good questionnaire and initial meeting help draw out these, often unspoken, concerns.

Some of the top concerns and issues elderly clients might have include:

- Ability to stay at home

- Costs to stay at home

- Trying to keep children happy and not rock the boat

- Refusing children’s care

- Remaining the parent, even when ill

- Loss of dignity

- Not being a burden

- Choosing the right people to name in their legal documents

- Ensuring loved ones understand their wishes and recognize the boundaries

Some of the common family concerns (besides the major underlying thread, which is usually worry over Mom or Dad’s well-being and a desire to ensure it moving forward) we see in our work include:

- Children concerned parent cannot afford desired choice

- Children concerned regarding their potential need to help pay or provide for care

- Family turmoil and breakdown over lack of direction by parent

- Sometimes it comes down to one of the biggest decisions which is whether to spend all the money on any care needed or protect assets and choose Medicaid/public benefit options (particularly when long term planning was not done in advance).

With a proper understanding of these issues and a good conversation started, the professional can now share his/her expertise with the client and family to help them understand topics that need to be addressed and implications of different decisions/options. Check out our checklist of items to review during eldercare planning with the client and family, for more detail.

Coordinated eldercare planning centered around the client offers an approach which not only works, but helps all members of the client care team do a better job. The benefits of coordinated planning include:

- Choices for the client and family (planning opens up more options)

- Reduced suffering

- Peace of mind

- Maintaining dignity and independence

- Bringing together the power of your circle of care (rather than dividing their strengths and potentially working at odds)

For more information on eldercare planning, contact us at 727-447-5845 and read our blog for regular updates and information. You can email us to receive our monthly Wise Words™ newsletter or to meet to talk further about coordinated eldercare planning for your loved one or client.

Popular Downloads

Popular Downloads

Get Our Newsletter!

Get Our Newsletter! Mission Statement

Mission Statement